Europe wants to put an end late payments

It is well known and suffered by SMEs and self-employed that one of the worst problems that they face during its activity are late payments and the prolonged wait to get the bills paid. The economic reality demonstrates every year the pervasive nature of this structural challenge and its profound impact on the entire European Union.

According to the authoritative European Payment Report 2023 by INTRUM, as many as 84% of surveyed European enterprises were asked to accept longer payment terms than they were comfortable with.

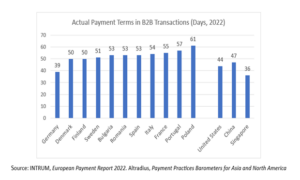

INTRUM also shows how substantial differences in payment terms remain among Member States, as well as with major competing economies, such as the United States and China (see graph).

Source: INTRUM, European Payment Report 2022. Altradius, Payment Practices Barometer for Asia and North America.

Several studies demonstrate how excessively long payment terms lead to a significant reduction in cash flow, which translates into increased risk of bankruptcy, reduced competitiveness, or problems in accessing finance.

In this sense, the European Commission’s Joint Research Centre (JRC) predicts an aggregate cash flow increase of 221 million if payment terms were set at 60 days.

Late payments are, therefore, one of the causes that have the greatest impact on the liquidity of European companies (especially in the case of SMEs), particularly affecting their competitiveness and viability.

¿What has been done to solve it?

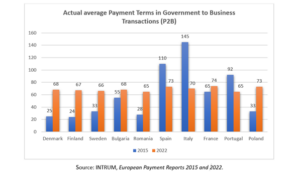

The Directive 2011/7/EU on Combating Late Payments in Commercial Transactions represented a breakthrough in Union legislation on this matter. Despite containing ambiguous concepts such as “grossly unfair terms”, its strict implementation in countries like Spain, Portugal, and Italy has led to a historic shortening of payment terms, both in B2B and government to business transactions (P2B).

Despite the advances established by this legislation, payment terms have worsened in many Northern and Eastern European Member States, and they still remain high across the Union.

Source: INTRUM, European Payment Reports 2015 and 2023

Source: INTRUM, European Payment Reports 2015 and 2022

Without a doubt, thirteen years after its entry into force, a thorough reform of the directive is clearly needed.

The new Late Payments Regulation

On September 12, 2023, the European Commission published its proposal for a new regulation on combating late payments, COM (2023) 533 final, which contains very ambitious provisions, namely:

- Regulation legal form: in contrast to a directive, this format will guarantee a timely and harmonised implementation of the new rules across the EU’s Single Market.

- The removal of “grossly unfair” contractual terms: this ambiguous concept led to worse and larger payment terms, as it represented a reason for abuse in commercial transactions, between large companies or governments and small enterprises with weaker bargaining power.

- Maximum payment terms of 30 days: for both Business to Business (B2B) and Government to Business (P2B).

- Dissuasive and concrete interest rates (8% above base rate) and recovery costs (50€ per transaction) have been set for payments exceeding the 30-day deadline.

- Enforcement authorities to be appointed in all Member States, with strong rights and power to monitor, investigate and sanction payment practices.

While Directive 2011/7/UE did not harmonize and discipline the payment culture across the EU. The European Commission’s Proposal sets a strong base in its right direction.

What do we request?

The European Parliament’s Committee on Internal Market and Consumer Protection (IMCO) will vote the amendments to the European Commission’s proposal. We strongly suggest upholding the European Commission’s Proposal as a solid step towards disciplining and harmonising payment terms in the EU.

- A maximum payment term of 30 calendar days after the provision of services or delivery of goods.

- The “grossly unfair” concept should not be reintroduced: this concept has led to considerable uncertainty in the current Directive.

- No sectoral exceptions for specific goods, such as slow-moving or seasonal goods, should be introduced.

- Limiting freedom of contract: as it only benefits large companies by imposing contractual conditions on micro, small and medium-sized companies.

- Banning means of payment that could be used to extend payment terms and increase costs to the creditor, as is the case with the reverse factoring.

- The creditor cannot waive its right to claim interest and compensation: these rights should be automatic, as stipulated in the Commission’s Proposal.

Síguenos en